FinTech has changed the face of the sector – moving out of the mire of analogue and into the dynamic world of digital, improving customer service and making it easier than ever for consumers and business to be in control of their finances.

New innovations are undoubtedly around the corner and Fintech is set to become even more important in our day-to-day lives.

Whatever happens, I for one am excited.

As the industry continues to expand and work its way into every facet of our lives, the financial services landscape has become almost unrecognisable compared to just ten years ago — and it’s easy to see why.

The UK is one of the most dynamic and innovative markets for FinTech, with investment in the sector reaching a record high of £16bn in 2018.

In its latest Pulse of FinTech report, KPMG found that total investment in the UK was almost four times higher in 2018 than the year before.

Not only that, but half of the top 10 deals in Europe last year took place in the UK, further cementing our status as the FinTech capital of Europe.

To put it simply – FinTech is the emergence of innovative technologies that are disrupting the financial services industry to address the ever-changing needs of customers.

Because of consolidation within financial services over the last few decades and continued regulatory restraints, traditional firms have found it harder to adapt to the new technological landscape than start-ups.

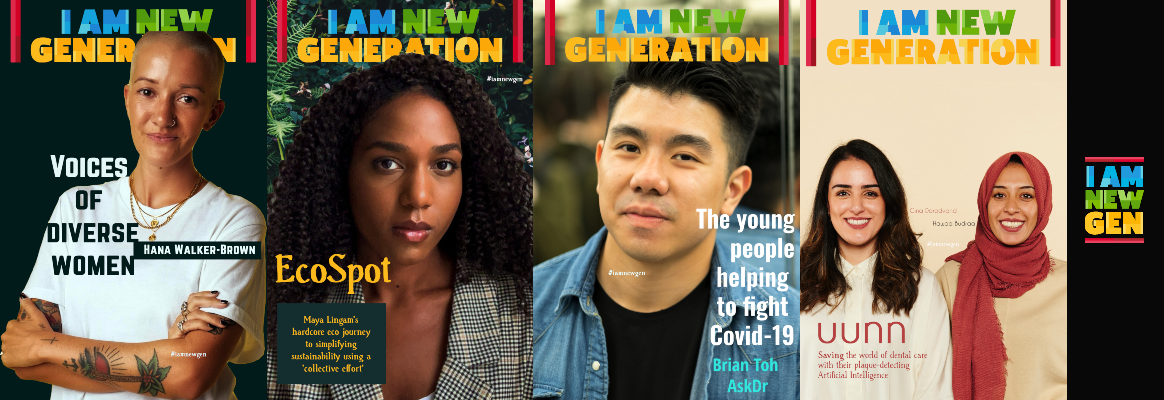

These are often headed by young, hungry entrepreneurs who can drive their ideas forward and bring them to bear on the industry.

Traditional financial institutions across the globe have been fearing this surge for quite a while and, although some of them are starting to invest in proprietary technology and acquire innovative FinTech startups, it is the smaller and more agile companies, who are less entrenched in traditional methods, that are storming ahead of the banking behemoths.

Facing these challenges, financial services firms have either looked to build their own technologies or partner up with smaller firms to help drive innovation.

Though they have been slow to adapt, it seems many are now pursuing a combination of both.

And, the industry shows no signs of slowing down, with artificial intelligence, machine learning, and big data becoming increasingly popular areas of exploration as firms continue to push forward new innovation.

There are many ways that technology will drastically change the face of financial services over the next few years, and many of them are already taking hold:

1) Robot Customer Service

Using natural language processing and machine learning to communicate with customers already exists, but the technology is limited.

Improvements in this space will see customer service improve by reducing waiting times while reducing costs for cash-strapped start-ups and big corporations alike.

2) AI Security

Human fraud teams already rely on technology to help identify cases of fraud, but also to protect systems from potential attack.

This is still a huge cost to businesses and ripe for innovation. As artificial intelligence develops, companies will be able to analyse vast amounts of personal and security data in real time using a fraction of the manpower.

3) Mobile Banking

With the continued success of digital challenger banks and changing consumer trends towards a cashless society, it is only a matter of time before brick and mortar banks become obsolete.

The world is going mobile — everything can now be done from the palm of our hand — and that is seemingly what consumers want.

4) Biometric Security

It has become clear that biometrics are the future of personal security, with many devices now requiring fingerprints and even retina scans to gain access.

This trend will only spread into more areas of our lives — a totally unique personalised password you can’t forget. NatWest is already pushing forward in this area with biometric integration for contactless payment cards.

5) Blockchain Transactions

Though the hype around cryptocurrencies has somewhat died down since the furor in 2017, blockchain technology remains a very promising prospect for financial institutions.

It will be able to reduce the costs involved in transferring money, within the framework of inherent trust and openness that blockchain provides.

Post By: Richard Litchfield is Head of Operations at P2P lending platform Lending Works.

Images – Unsplash (Main photo – Jonas Leupe; In-Article photo – David Travis)